Content creation is a fairly recent profession, and those who work in social media are classified as self-employed by the IRS. This means that content creators and influencers might be eligible for certain deductions.

Maximizing Your Earnings as an Online Content Creator.

As a content creator, such as a YouTuber or Instagram influencer, sharing your knowledge and talent online can be an exhilarating experience. You're the authority, and people are eager to pay for what you know. It can also be fulfilling as your social media following grows and revenue flows in. However, it's critical to keep tabs on your income and expenses to ensure that your tax return is accurate. Here are answers to some of the most frequently asked tax questions for content creators and influencers.

Reporting Income as an Online Content Creator.

As a social media influencer, performer, blogger or any other type of online content creator, it is your responsibility to report any income you make from your online activities. Since you're self-employed, you won't receive a W-2 from the companies that sponsor you. Instead, you will receive a Form 1099-NEC from every partner that pays you $600 or more. It's essential to note that you must report all income you receive, even if it is less than $600, on your tax return.

Utilizing Social Media Influencers for Exposure: Taxable Gifts Consideration

To gain exposure for their products, many companies provide social media influencers with clothing and gear. As an example, you may receive a branded hoodie, cosmetics, or even tech equipment to use for a photo shoot or video. However, if the content creator or influencer is expected to perform a service in exchange for the gift, then it may be subject to taxation. Keep in mind that there are exceptions, and every situation should be assessed on a case-by-case basis.

Tax Filing for Content Creators: What You Need to Know

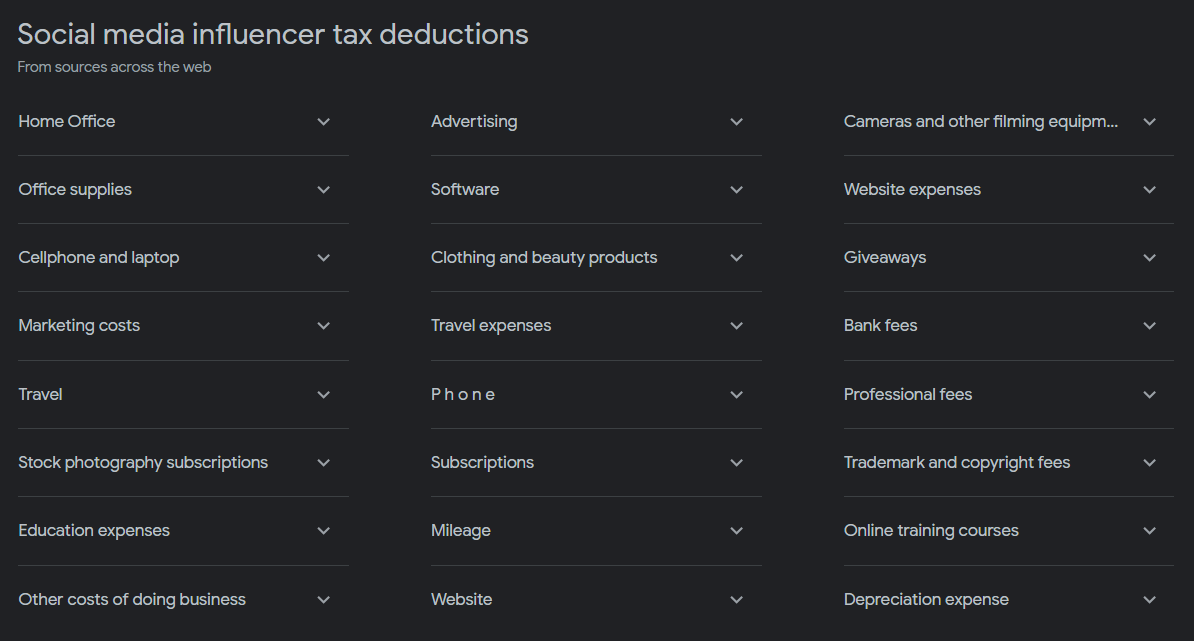

Whether you're a full-time content creator or just doing it on the side, it's important to file your taxes properly. As a self-employed individual, you'll need to use Schedule C, Profit or Loss From Business, to report your income and expenses related to content creation. This tax form is also used to report deductions linked to your business. Once you've subtracted these costs from your gross income, you'll get your business's net profit or loss. It's worth noting that social media influencers and small business owners use the same tax forms. If you have multiple jobs, you'll need to file taxes for each one separately.

Maximizing Your Home Office Deductions

Are you working from home and have a designated workspace for your business? You may be eligible to deduct a portion of your household expenses, including your rent or house payment and utilities. You can either calculate these expenses individually or use the IRS-provided formula for deducting a home office.

Balancing Deductible Expenses and Earnings for Your Business

It's not uncommon for your deductible expenses to exceed your earnings. It is acceptable to report a business loss in such cases. However, if your content creation or influencer activity consistently fails to generate a profit, the IRS may consider it a hobby. This means that your business tax deductions may be disallowed by the IRS.

If you want to demonstrate that your content creation is a legitimate business, the simplest way is to report a profit. When your business reports a profit within three of the last five tax years, the IRS will typically recognize it as a bona fide business. Moreover, the IRS may evaluate the time and effort you've invested in your business, as well as its potential for future profits. However, if your content creation or influencer activity consistently fails to earn a profit, the IRS might categorize it as a hobby. In that case, the IRS will disallow your business tax deductions.

Who pays my Social Security and Medicare taxes?

As an employee of a company, both you and your employer contribute to your Social Security and Medicare taxes. However, when you run your own business, you're responsible for both the employer and employee portions of these taxes. This combined tax is known as the self-employment tax and is separate from your income tax. Even if you don't owe federal income tax, you are required to pay this tax on the profits from your business.

When do content creators pay taxes?

Similar to traditional businesses, business owners must pay withholding and Social Security taxes to the IRS throughout the year. Rather than waiting for the April 15 income tax deadline, owners should make regular tax payments on a quarterly basis. To determine the amount of the payments, estimate the taxes owed for the entire year and divide them by four. These payments are due on April 15, June 15, September 15, and January 15. Failing to make payments on time may lead to a tax penalty. However, if the tax obligation was less than $1,000 in the prior year, quarterly tax payments are not required.

Thank you for joining us on this journey through the exciting world of social media content creators. In today's digital age, self-employment has taken on a whole new dimension, and social media content creators are leading the way.

As we conclude this blog, we hope you've gained valuable insights into the opportunities, challenges, and strategies that come with this unique form of self-employment. Whether you're already a content creator looking to elevate your game or someone considering diving into this dynamic field, remember that success in the world of social media content creation is about passion, persistence, and creativity.

Our team at My Business Alternatives is here to support you every step of the way. We're committed to helping you explore new avenues for self-employment, discover your unique voice, and build your brand in the digital sphere. Your journey as a social media content creator is not just a job; it's a lifestyle, a chance to connect with audiences worldwide, and a path to financial independence.

Stay inspired, stay creative, and never stop sharing your unique perspective with the world. If you have any questions or need further guidance, don't hesitate to reach out to us. Together, we'll unlock the endless possibilities of self-employment in the age of social media.

Thank you for being a part of the My Business Alternatives community, and we look forward to accompanying you on your exciting journey ahead.

Comments ()