Understanding the New “Trump Accounts” Guidance — A Clear Breakdown for Our Community

The Treasury Department and IRS recently released new guidance explaining how the new “Trump Accounts,” created under the Working Families Tax Cuts, are expected to operate. Because this is a brand-new provision, many families are unsure what these accounts are, who qualifies, how funds can be used, and when additional rules will be announced.

This post is designed to give our community a simple, clear, and neutral explanation of what we know right now — based only on verified IRS and Treasury information.

My goal is not to support or oppose any tax law, but to provide a trustworthy place for families to understand what is, why it matters, and how it may affect them.

What Are “Trump Accounts”?

Under the Working Families Tax Cuts, certain taxpayers may become eligible to open designated accounts — informally referred to as “Trump Accounts” — intended to support family financial stability.

The IRS and Treasury have not yet released all operational details, but the guidance outlines:

-

Who may qualify based on tax filing status and income

-

How the accounts may be structured

-

When families can expect additional regulations

-

What the accounts will not do, to avoid misinformation

Because this is an early-stage program, rules may evolve as official regulations are finalized.

What the New IRS Notice Explains

The notice released by the IRS provides a preview, not the final rulebook. Key points include:

✔ These accounts are not yet active

No taxpayer can open or use a Trump Account until the Treasury issues full regulations.

✔ The IRS will publish more detailed rules soon

The notice serves as an announcement that these rules are being developed.

✔ Eligibility will be tied to income and filing status

The IRS will define which taxpayers qualify once the regulations are complete.

✔ The accounts may be used to support certain household or financial needs

IRS notes suggest that these accounts will have specific permitted uses, similar to how HSAs and FSAs operate, but details are still pending.

✔ No taxpayer action is required right now

Families do not need to apply, update their return, or make any changes until official guidance is issued.

What Families Should Expect Next

Based on the IRS notice, taxpayers should be aware of the following upcoming steps:

1. Additional IRS Regulations Are Coming

The notice announces that the Treasury and IRS are preparing more complete rules. These will determine:

-

How accounts are opened

-

How funds are deposited

-

Whether funds are refundable, advanceable, or claimable at tax time

-

Whether the accounts will be managed by banks, the IRS, or another agency

2. Eligibility Will Be More Clearly Defined

Families will soon know:

-

Whether eligibility is automatic or application-based

-

Whether it varies by household size or dependents

-

Income thresholds and phase-outs

3. Guidance Will Explain How Payments Work

The IRS has not yet announced:

-

How much families may receive

-

Whether payments will be annual, monthly, or situational

-

How balances roll over or expire

All of this will be included in upcoming regulations.

What Families Should Not Do Right Now

Because misinformation spreads quickly, it is important to note what families do not need to do:

❌ Do not apply — there is no application yet

❌ Do not update your tax return for this program

❌ Do not assume your benefit amount

❌ Do not share personal information with anyone claiming to “set up your account”

❌ Do not expect funds immediately

The IRS will announce when actions are required. Until then, simply stay informed.

How This Guidance Helps Families Prepare

Even though the accounts are not active yet, the IRS notice helps families:

-

Know that more information is coming

-

Understand that eligibility will be defined soon

-

Plan for upcoming programs without making premature decisions

-

Recognize official guidance vs. misinformation

-

Avoid scams related to new tax law changes

Understanding the process early helps families feel more confident and prepared.

How My Business Alternatives Supports the Community

My role is to help our community stay informed with clear, accurate, and verified tax information — without expressing agreement or disagreement with the law itself.

If you want updates as soon as new regulations are released, or need help understanding how these changes may affect your household, I’m here to support you.

👉 Join the MBA Client Portal:

https://mybusinessalternatives.com/client-portal

👉 Schedule a Tax Questions Consultation:

https://mybusinessalternatives.com/contact

👉 Get help navigating IRS updates and notices anytime.

Related Posts for More Understanding

-

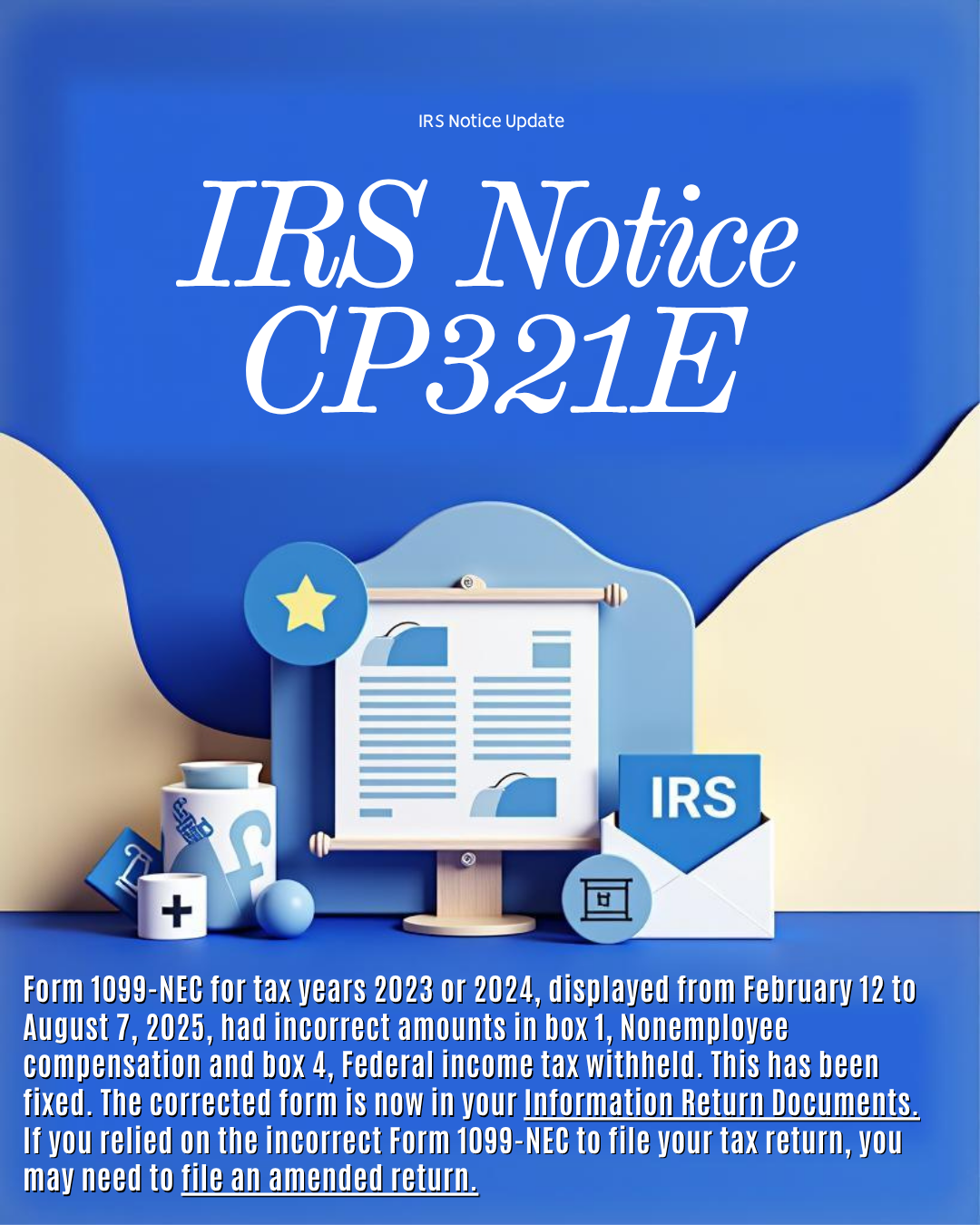

IRS 1099-NEC Error Letters: What You Should Know Before Amending Taxes

https://mybusinessalternatives.com/tax-pulse/irs-1099-nec-error-letters-what-our-community-should-know-before-amending-taxes -

Recent Updates to the Standard Deduction

https://mybusinessalternatives.com/tax-pulse/recent-updates-to-the-standard-deduction-what-taxpayers-should-know -

Understanding the 2024 Tax Bracket Changes

https://mybusinessalternatives.com/tax-pulse/understanding-the-2024-tax-bracket-changes-what-you-need-to-know -

IRS Identity Verification Requirements

https://mybusinessalternatives.com/tax-pulse/irs-update-new-identity-verification-requirements-with-id.me-what-taxpayers-need-to-know

Final Thoughts From My Business Alternatives

My goal is always to help our community understand what is, why it matters, and how to prepare — without taking a position on the tax law itself. As new guidance is released, I will continue breaking it down in simple terms to support families, taxpayers, and small businesses.